Transactions are the daily core activity of any type of business. From buying high-in-demand products to selling back to the consumers to purchasing items for supplies to selling goods or services to customers, right through to paying and managing subcontractors. Every transaction requires a clear and concise record.

This is the reason why we need invoices for our businesses! And a majority of the businesses prioritize these. A survey concluded that 66% of businesses spend at least 5 days a month processing invoices!

An invoice is a legal document that itemizes a transaction between a buyer and a seller. Where the goods and services are bought of credit then the terms of the deal are usually stipulated in the invoice with detailed info outlining the quantity of goods sold, their prices, and a host of other related information.

Different types of invoices are central to the conduct of the business transactions. They are important tools used by businesses to manage their cash flow and monitor their inventory levels. At the same time, they provide some legal evidence pertaining to the transactions for purposes of taxation and auditing.

They also contribute a big part when it comes to customer relationship management because timely and accurate invoices contribute to the satisfaction of customers.

In this blog post, we will talk further about the different types of invoices and explain their purpose while bringing to attention when it's best to use them and how they are made.

An invoice is a commercial document that lists the items and details of a business transaction between a buyer and a seller. It also serves as a bill for goods or services rendered and as a request for payment sent by the seller to the buyer.

However, beyond its fundamental roles, an invoice is also significant in bookkeeping, tax filing, as well as financial forecasting.

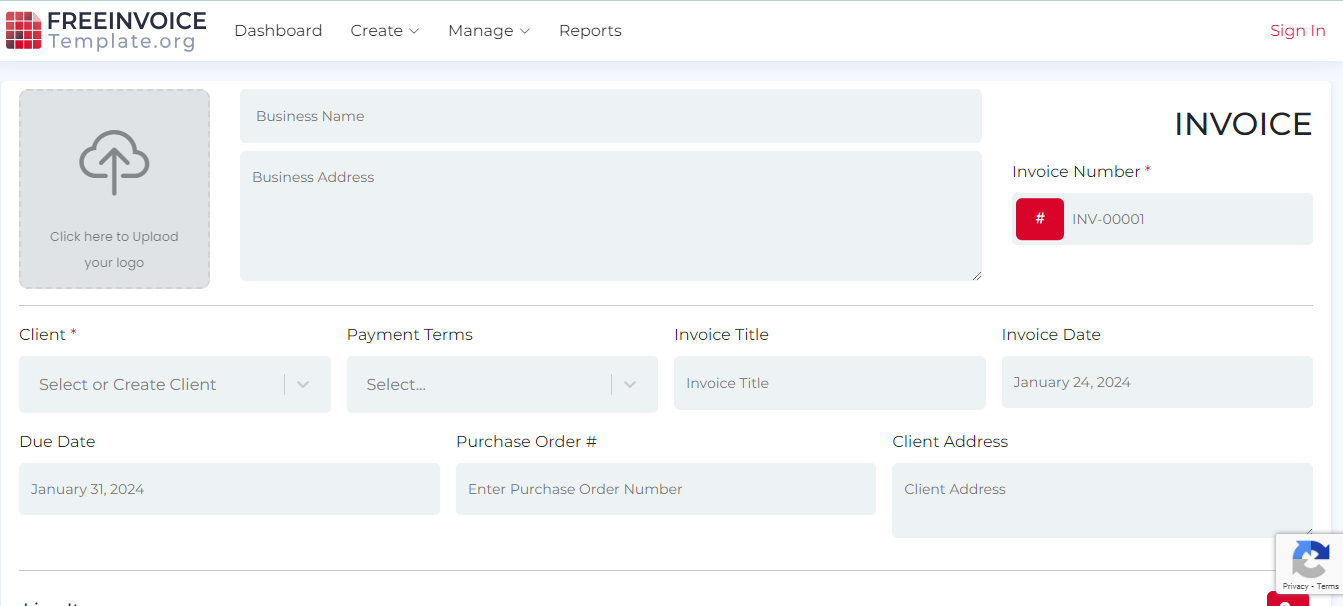

Elements of a standard invoice will generally include:

It needs to be mentioned here that these elements can be sufficiently well understood when understanding invoicing in totality. There are several types of invoices for various business transaction situations. We will discuss them below in detail.

The document is not legally binding and does not in any way act as a binding demand for the payment. Instead, it's an explicit statement of what is being transported, the value of the items, and other costs associated with the shipment. The same information as that of creating a standard invoice is added in it to create a proforma invoice.A proforma invoice simply refers to a preliminary bill of sale that sellers forward prior to shipment or delivery of goods or services. It is more prevalent in international trade, where exporters will create proforma invoices and send them to importers before the shipment.

Therefore, the document needs to be specifically and clearly labeled as the 'Proforma Invoice' so that it does not get confused with the final invoice.

The document should carry the information of the seller and that of the buyer, a description of the goods or services, pricing, as well as shipping fees or any additional charges. Interim invoices provide periodic collections until the due date of the final payments, for tasks or jobs spanning over a long period.

It enables businesses to charge customers little by little without requiring them to settle many amounts all at once. Also, it helps in conducting cash flow easier, as the payments from customers can be managed properly.

In the interim invoice, the billing period should be clearly stipulated. For example, if you're billing monthly for a year-long project, each invoice might cover one month's worth of work.

As such, the invoice should consist of all the standard elements: your business information, your client's information, an invoice number, the date, a description of work done in a specified period, and the amount due for that period.

It is also recommended to ensure that all the interim invoices are duly followed up so as to avoid either overcharging or undercharging the client when eventually the final invoice is being done.

Once a project or transaction is completely done, the final invoice will be issued to the final consumer. It shall then be considered as a request for payment to the business. A final invoice applies in various business scenarios, normally following up interim invoices or it can take the position of a proforma invoice after delivering goods or offering services.

Developing a final invoice entails overviewing the supplied goods or services and the cost of each one of them together with the total amount that is to be paid. If any interim invoices were issued, these should be mentioned and deducted from the final amount.

This document should be clearly labeled at the top as 'Final Invoice' and carry with it standard elements such as seller's and buyer's details, unique invoice number, date of issuance, payment terms, as well as the total amount due.

This is basically just a reminder sent to the customers who have not paid their bills by the due date. It reminds them to make the payment, and as such most businesses often utilize it in a bid to ensure that there is constant cash flow within the business.

In essence, the past-due invoice is an important way through which late bill payment might actually result in the collapse of any business.

Drafting a past-due invoice should be tactful. It should clearly tell that the payment is overdue and must mention the original invoice number, date of issue, and the amount due. One must be professional as well as polite at the same time while drafting without sounding aggressive or accusing.

Interestingly, 54% of businesses have made up their mind that they will be paid late.

Often, it should be advisable to add a brief about probable late fees (if any) or come up with a payment plan that will promote the customer in clearing the debt. The intention of a past due invoice ought to be seen not to only request funds but also a good rapport with the customer himself.

It is an invoice that businesses use for the customers they serve by offering them ongoing services that charge at regular intervals a constant amount. For instance, a business that deals in subscription-based services like software-as-a-service (SaaS) firms, internet service providers, or property rentals will use recurring invoices in most cases. It streamlines the entire billing cycle as payments are automated from where the revenues come.

If your invoicing software supports this feature, then setting up a recurring invoice is not a big deal. Include standard details like your business information, your customer's information, invoice number, and date.

Ask for a billing period (weekly, monthly, yearly, etc.) description of the goods or services provided. Set the invoice amount which should remain constant across all periods unless changing your terms. Once set up, the recurring invoice should be generated and sent automatically as per the defined schedule.

A credit invoice is an instrument available to the seller in order to show that an amount has been credited to the account of the customer, and this may be broadly called a credit memo or credit note, as required. It is used when goods are returned and the seller will need to refund the buyer.

Creating a credit invoice is just similar to creating a standard invoice but in a reverse manner. It should contain your details, that of the customer, the unique credit invoice number, and the date. It should detail just what credit is being issued for and how much is being credited.

The document should clearly indicate prominently 'Credit Invoice' or 'Credit Note' on the top section so as not to create confusion. Always remember to make alterations to your financial records so that they can reflect this credit transaction.

A debit invoice is a commercial document raised by the seller towards the buyer to indicate further charges or adjustments in an upward direction to the total payable from the buyer. It applies in the case of an under-billing error in a past invoice, or when a provision of additional goods or services is not originally factored into the original invoice.

To create a debit invoice, include the standard invoice information such as your business details and that of the customer to be charged, the unique debit invoice number, and the date. Clearly detail what exactly is the reason for the additional charge if it is as a result of an under-billing error or extra goods or services provided.

Clearly indicate the total amount on debit. Clearly label the document as a 'Debit Invoice' or a 'Debit Memo' to avoid any misunderstanding.

A sales invoice is a document detailing information on goods or services sold, quantities, prices, terms (amount of discounts if applicable), taxes, amount due, and payment terms, issued to a customer or buyer by the seller.

To create a sales invoice, first, enter the details of your business and then move to the consumer's information. Create an appropriate unique invoice number for tracking purposes and place the date. List all the products or services sold with their quantities and unit prices.

Calculate and itemize any discounts and taxes in separate totals. Lastly, calculate the total due all up prominently at the bottom of the document. Depending on the business payment terms may also be due for stating as well as the due date. Be sure that somewhere on the top, it is clearly labeled as a 'Sales Invoice.'

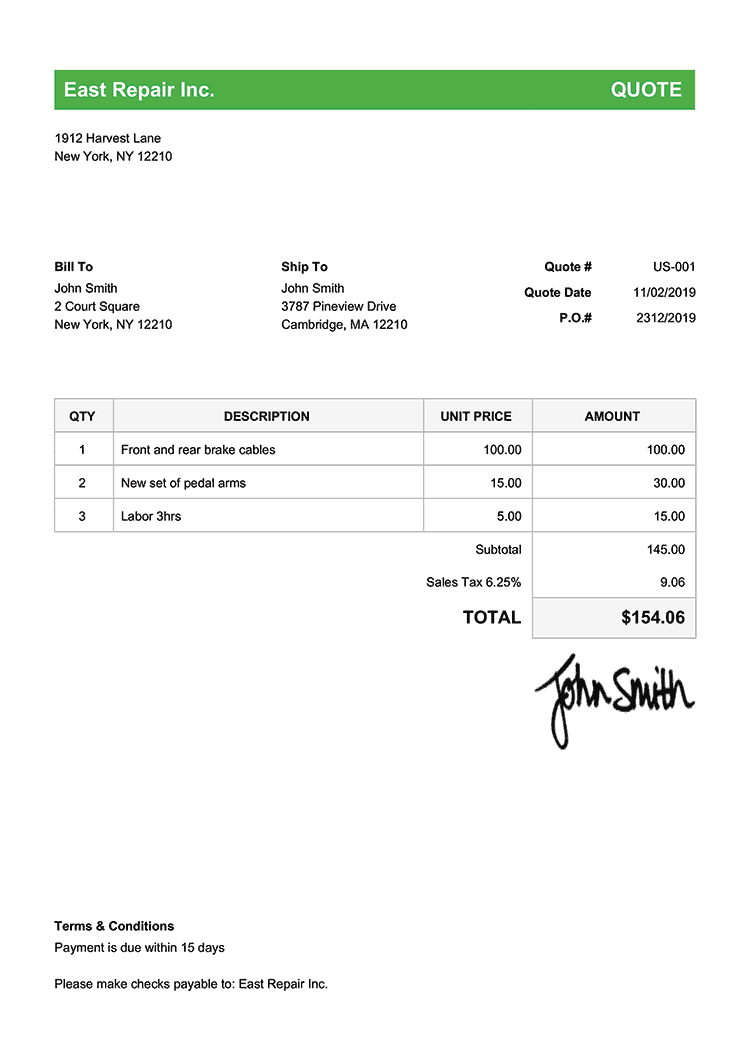

A quote, also called a sales quote or price quote, is one of the essentials in the sale and purchase process. It is a formal document of cost induction that a vendor hands over to the prospective buyer at the start of the selling process. The quote remains accepted within a fixed period.

This information comprises descriptions and specifications of items, quantities, unit prices, total cost, terms and conditions of sale, as well the validity period of the quote. The essence of the quotation is to give the potential customer a guideline on the proposed work or products before any agreement is done so as to inform him/her of costs that will be incurred.

Importantly, quotes have no impact on a business's accounting books until they are converted into invoices after the customer accepts.

Similar to a quote, yet with slightly different intent, is an estimate. It is the professional guess of the costs that would be allocated towards that particular job or project at hand. Estimates are common in industries that bill work by time and materials such as the construction trade, consulting, or freelance work.

It usually considers the different factors such as labor charges, material costs, overheads, and profit margins to give an approximate idea of the total cost of the client. It is however likely that as much as the initial estimate sets out the required resources for a project, there may be variance in the final invoice amount.

This is due to unforeseen expenses, changes in scope, or other variables throughout the lifecycle of the project. Estimates hence have been considered as flexible as compared to a quote.

On the other hand, the lone word credit memo is an abbreviation for credit memorandum showing a decrease in the amount owed from the buyer to the seller. It's issued especially when goods are returned or there has happened a mistake in the original invoice which makes the buyer pay more than he should have paid.

A vendor may also issue a credit memo in case he wishes to extend a discount to the buyer, either for goodwill purposes or in order to correct an earlier customer service mistake. The memo will contain the reason for the amount being credited together with the actual amount to be credited and the invoice number of the initial document.

It is important to note that when a credit memo is issued, there will be no refund in cash to the buyer but rather helps reduce the outstanding balance or can apply for future purchases.

Purchase Orders (PO) are among the essential documents in business that place an order from a purchaser to a seller. It specifies the kinds of products, quantities, and prices agreed upon. It may be specifications of the product, conditions of delivery, conditions of payment, or any other term relevant to a purchase.

The acceptance by the latter of a purchase order causes a contract to be formed between the buyer and the seller. This makes it a valuable tool for businesses to control their spending and manage their cash flow effectively.

This is an indispensable record-keeping tool as it has information that is useful in tracking purchases, managing inventory, and even reconciling accounts over time.

More than just a bill, but more of a legal document that is issued by the seller towards the customer serving as a detailed statement of the goods or services that are taxable. Overall, the invoice includes the name and address of the business, tax registration number, description of goods or services sold, date of supply, and the amount of tax payable. In other words, the document is of great importance to the taxation system.

That way, it is necessary for two reasons: one being claiming the input tax credits that would enable in refunding of the taxes they are paying on their purchase that relates to their taxable sales.

Two, it is a clear audit trail of all taxable transactions to regulatory authorities aiding in tax administration and compliance. Apart from its function in tax compliance, a tax invoice is equally an important record of sales to both sellers and buyers as well.

For the seller, it is proof of income whereas for the buyer, it is proof of purchase. Hence maintenance and proper keeping of accurate tax invoices is fundamental to good business practice.

Crafting proper invoices is very vital in maintaining a healthy cash flow as well as a professional relationship between the contracting parties. Below are some of the best practices which may guide you through this process:

Clearly define and concisely communicate a billing schedule : Whether weekly, monthly, or even upon the successful completion of the project. This ensures that such a schedule is communicated even during client onboarding and consented to.

Make it easy to pay : Give your customers plenty of ways to pay. Generally, in business, the easier you make it for clients to pay you, the faster you get paid.

Clear assignment and payment terms : Properly mention the due date of the payment along with the consequences of late payment.

Follow-Up Process : Maintain a systematic follow-up process for overdue invoices which should be done professionally without denting your relationship with the client.

Mastering the subtleties of different types of invoices and when to apply them will be a key facet to mastering competent financial management for business. From the standard sales invoice, recurring invoice, and debit invoice to credit invoice, each has its unique function and purpose.

So always keep in check your invoices because these amazing technical tools keep in check your business.

Author: Suzie Owens (Marketing Executive)